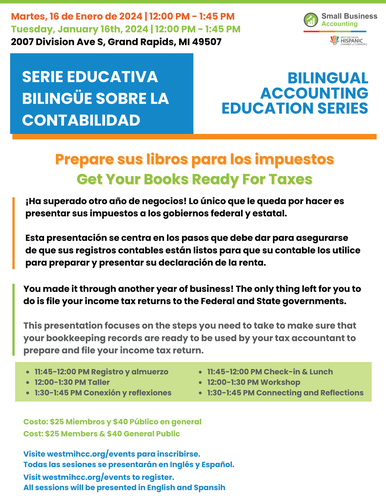

Bilingual Accounting Education Series: Get Your Books Ready for Taxes

You made it through another year of business! The only thing left for you to do is file your income tax returns to the Federal and State governments. This presentation focuses on the steps you need to take to make sure that your bookkeeping records are ready to be used by your tax accountant to prepare and file your income tax return.

¡Ha superado otro año de negocios! Lo único que le queda por hacer es presentar sus impuestos a los gobiernos federal y estatal.

Esta presentación se centra en los pasos que debe dar para asegurarse de que sus registros contables están listos para que su contable los utilice para preparar y presentar su declaración de la renta.

Date and Time

Tuesday Jan 16, 2024

12:00 PM - 1:45 PM EST

January 9th

11:45-12:00 PM Check-in & Lunch

12:00-1:30 PM Workshop

1:30-1:45 PM Connecting and Reflections

All sessions will be presented in English and Spanish

Location

Participants will learn the following:

• Six steps you must take to prepare your books for tax filing.

• Difference between a Management Accountant and a Tax Accountant…and the important roles that each play in your business.

• Reconciling your books, writing off bad debt, reviewing your financial statements, and ensuring your books are accurate.

• Common red flags that the IRS uses to catch errors and omissions.

• ...and more!!!

Target Audience

• Small for-profit business (in any industry). • NOT recommended for non-profit businesses (we do not cover Form 990 filings in this presentation).

Fees/Admission

$25 Members | $40 General Public

Costo: $25 Miembros y $40 Público en general

Contact Information

Bill Espaillat and Jennifer Roys

Send Email